Luckily, there is a viable solution that will allow for the growth you need, while at the

same time protecting your principal from market downturns. When you are ready to

convert your savings to income, it will provide you with a guaranteed lifetime income stream for the rest of your life. These guarantees are not related to securities, variable, or investment advisory products. Instead, the guarantees are related to life insurance and annuities, which are subject to product terms, exclusions and limitations, the insurer’s claims-paying ability, and financial strength of the issuing insurance company

The Retirement Savings and Income Solution

One income solution is a fixed indexed annuity, or FIA. The best ways to describe how a fixed indexed annuity works during its accumulation phase is to imagine a set of stairs. When the underlying index goes up, you move up a step or two. However, when the underlying market index goes down, you remain on the same step. In other words, you do not drop with the market.

With a fixed indexed annuity, your previous gains are locked in, and you won’t see a negative on your statement. In addition, most of these annuities will also offer you a guaranteed minimum return. This is because your annuity

contract value is protected by the insurer’s claims-paying ability, and the financial strength of the issuing insurance company.

How Zero Can Be Your Hero

When approaching retirement, having your funds protected from market risk can be a smart way to go. While growth in the market can certainly have its rewards, risk still exists. Loss is always possible in the markets and takes a certain amount of time to recover.

Purchasing a fixed indexed annuity can be a great way to take advantage of growth in the underlying market or

protect principal during times of negative market performance.

During the accumulation phrase of the FIA, the growth in the contract value is dependent upon the credit method

and index selected. Each credit method has its own benefits and drawbacks, which should understood before

selecting a particular crediting method. One crediting method used is called the annual point-to-point. Crediting

interest to the FIA account in this manner will track changes in the underlying market index from one contract anniversary of the annuity to the next. This is referred to as the point-to-point method. It is important to remember that no indexing method is necessarily superior to another; each method will result in different interest crediting, depending on yearly market performance as well as the cap rates associated with each product.

Fixed indexed annuities will typically have a cap rate that affect how interest is treated. These caps limit the upside

potential of increases in index value. The cap will determine how much the annuity can earn within a certain period of

time. If the percentage change in the index is negative, then per the contract the annuity holder will never be credited

less than zero.

Even if the underlying index ends the year with a negative 10% return, the annuity holder will still be credited with

zero. While you won’t gain anything for that particular period of time, you also won’t lose. In short, “zero is your hero”

because your annuity contract value is protected by the insurer’s claims-paying ability and financial strength of the

issuing insurance company.

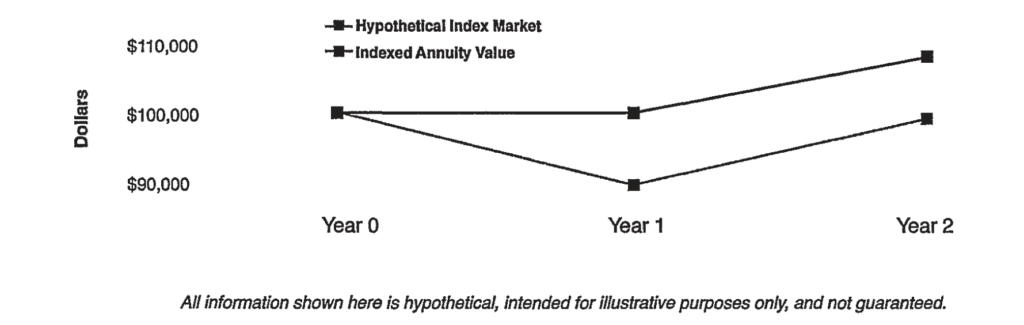

For example, if an individual deposits $100,000 into a fixed indexed annuity and the underlying index decreases by 10% in the first year, then the investor will not lose 10% of their principal. Instead, the annuity is simply credited with zero.

In the second year, the index has a 10% gain. However, the 7.5% cap on the annuity means that it is credited with 7.5%. Here, while the annuity owner did not receive the full 10% amount of interest, they can actually catch up on

re-earning their money because of the zero credit they received in the down market. The zero credit offers investors added peace of mind.

Before You Move Forward With FIAs

When considering a fixed indexed annuity contract, just as with any other type of financial vehicle, there are a few things to consider. First, past results do not indicate future performance or values. In other words, just because an FIA or an underlying index happens to be moving in one particular direction today, doesn’t mean that it will continue

that way tomorrow.

These products may not be for everyone. While certain features are important to some investors, such as tax-deferred growth or guaranteed lifetime income, it is essential to understand all of the features of the fixed indexed annuity. Always utilize the financial products and tools that will best meet your specific needs and goals.

For those looking for the opportunity to grow funds with minimal worry, a fixed indexed annuity is a nice alternative. In

addition, FIAs provide you with the ability to receive guaranteed lifetime income.

A fixed indexed annuity can help reduce concerns about ever outliving your funds at any point in your journey toward retirement.