Likewise, in order to qualify for Social Security benefits, a person must have earned enough work “credits.” Here, individuals—or their spouses—who have worked and paid taxes into the system for at least 40 quarters (ten years) will have enough credits to qualify.

Even though many retirees will receive some Social Security income at retirement, these benefits, according to the Social Security Administration, will only replace about 40% of an average wage earner’s pre-retirement wages.

When it comes to the personal savings “leg” of the three-legged stool, many retirees will convert these funds into an income stream using various strategies based on certain withdrawal rate strategies. For example, one method that has been popular in the past is known as the “4% rule.”

Using this strategy, individuals can determine a certain rate of income, while also assuming a certain rate of growth for the funds remaining inside of the portfolio, using a withdrawal of 4% each year.

But with today’s volatile stock market and increasing life expectancy, this type of retirement income strategy isn’t safe anymore. It can leave retirees open to running out of income and leave an investor open to the Order of Returns Risk.

Keeping the Savings Leg Protected from Order of Returns Risk

While many retirees are well aware of the risks to their income, the Order of Returns Risk is one that isn’t often highlighted.

Throughout the time an investor is planning for retirement, the market will go up and it will go down. We are often told that short-term fluctuations don’t really matter, as long as the overall return is positive.

Once a person retires, this can drastically change. This is because a negative return just before withdrawals start can have a long-term negative effect, causing your portfolio to drain even faster.

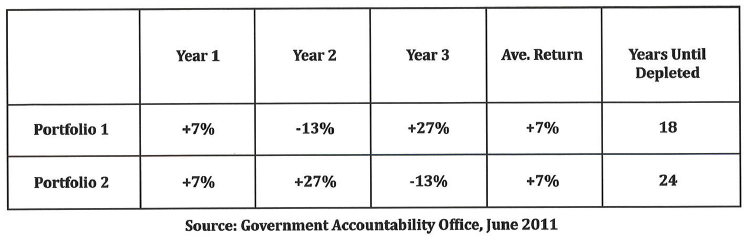

For example, two portfolios that have the same returns and the same overall average return of 7% can have a dramatically different end result.

Since Portfolio #1 had the negative return in Year 2 versus Year 3, it ran out of money six years earlier. With that in mind, it is essential to be mindful of the order of your returns.

Avoiding the Order of Returns Risk

Although market risk will always exist, a solution exists to help you to reduce the order of returns risk: a fixed indexed annuity. These financial vehicles can provide a variety of benefits, both during the accumulation phase in life when you’re still saving, as well as during the income stage in your retirement.

By linking your funds to the performance of a leading market index, you have the opportunity to attain credited interest rate of market growth. These vehicles can also provide principal protection even if the underlying index performs negatively, since these vehicles offer guarantees that are backed by the financial strength and claims paying ability of the insurer.

A fixed indexed annuity will therefore allow you to lock in gains, but not lose value. So, when the market rises, your funds can rise. But if the market goes down, your principal does not decrease.

When the time comes to convert savings into a retirement income stream, the lifetime option allows you to receive a guaranteed income for the remainder of your life. Choosing the joint life option allows you and your spouse to each receive lifetime income throughout both of your lives, without having to worry about it running out.

Knowing that your principal is protected and having a set amount of guaranteed lifetime income gives you more leeway in how your savings are invested. It can also make a difference in your overall retirement outlook.